Post Office PPF Scheme : Every parent aspires to provide their child with a foundation of security and opportunity. As the costs of education and skill development continue to rise, proactive and stable financial planning becomes a cornerstone of responsible parenting. Among the myriad of investment options, the Post Office Public Provident Fund (PPF) Scheme stands out as a time-tested, government-backed avenue for building a substantial, tax-free corpus for your child’s future through disciplined, long-term saving. This scheme isn’t about overnight wealth or high-risk bets; it’s about the quiet, powerful magic of consistency. By committing to regular, manageable contributions, you harness the power of compound interest, allowing small annual deposits to mature into a significant fund. This approach alleviates the future financial burden of major milestones, transforming anxiety into assurance.

The Unmatched Value of Steady, Disciplined Saving

The true engine of wealth creation in long-term plans like the PPF is not a large lump sum, but the habit of regular investment. When you invest a fixed amount each year, compound interest works relentlessly in the background, amplifying your savings in a way that sporadic investments cannot. This method is financially sustainable for most families and instills a valuable lesson in financial discipline—a gift as important as the fund itself for your child’s future.

A Complete Overview of the Post Office PPF Scheme

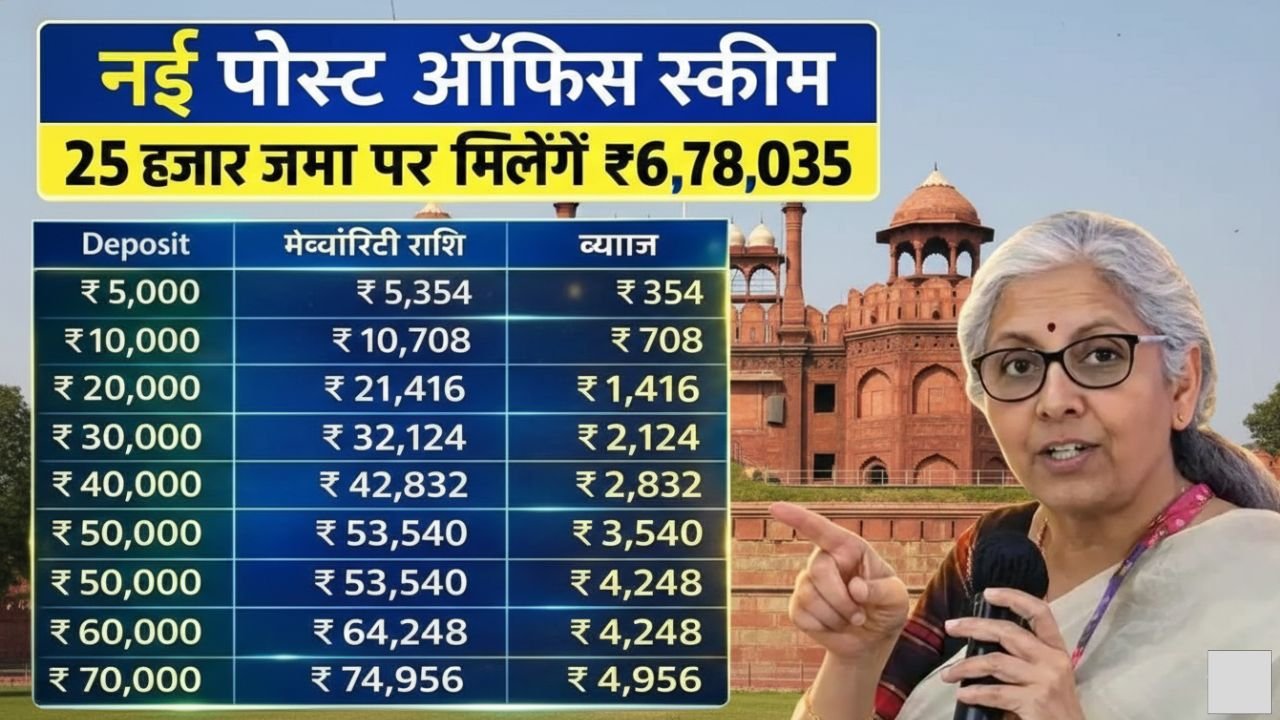

The PPF is a long-term savings instrument designed with stability and security at its core. Below is a detailed table summarizing its key features:

| Feature | Details |

|---|---|

| Scheme Name | Public Provident Fund (PPF) |

| Eligibility | Indian residents. A parent/guardian can open and operate an account for a minor. |

| Availability | Post Offices and authorized public/private sector banks. |

| Account Tenure | 15 years from the date of opening. Can be extended indefinitely in blocks of 5 years. |

| Minimum Annual Deposit | ₹500 per financial year. |

| Maximum Annual Deposit | ₹1.5 lakh (across all PPF accounts held by an individual). |

| Interest Rate | Set by the Government of India and reviewed quarterly. |

| Interest Calculation | Calculated on the lowest balance between the 5th and last day of each month, credited annually. |

| Tax Benefits | EEE (Exempt-Exempt-Exempt) status: Deposits eligible for deduction under Section 80C, interest earned is tax-free, and maturity amount is fully tax-free. |

| Lock-in Period | 15 years. Premature closure is not permitted except in specific compassionate circumstances. |

| Partial Withdrawals | Permissible from the commencement of the 7th financial year, subject to terms and conditions. |

| Loan Facility | Available against the balance from the 3rd to the 6th financial year. |

| Risk Profile | Virtually risk-free, as it is backed by the sovereign guarantee of the Government of India. |

How the Scheme Fosters Long-Term Security

The 15-year lock-in period, often seen as a restriction, is actually the scheme’s greatest strength for goal-based planning. It ensures the savings remain dedicated to their original purpose—your child’s future—guarding against impulsive withdrawals. By the time your child is ready for higher education or vocational training, a reliable and substantial financial resource is already in place, empowering them to pursue their aspirations without constraint.

Stability in an Uncertain World

In a financial landscape often dominated by volatility, the PPF offers a sanctuary of predictability. Its government-defined interest rate provides insulation from market fluctuations, offering peace of mind to investors who prioritize capital preservation and steady growth. This makes it an ideal cornerstone for the long-term, goal-oriented portion of a family’s financial portfolio.

The Advantage of Triple Tax Exemption

The PPF’s tax efficiency is a significant advantage. Contributions reduce your taxable income, the interest accumulates without any tax deduction, and the final maturity amount is yours to use entirely, free from tax. This triple-layered benefit ensures that your savings grow at an effective rate that is often higher than comparable taxable returns, maximizing the final corpus for your child.

A Scheme for Every Family

The PPF’s design is inherently inclusive. With a low minimum investment threshold, it is accessible to families across income spectrums. You can start small and increase contributions as your financial capacity grows, making it a versatile tool for long-term wealth building that adapts to your life journey.

Frequently Asked Questions (FAQ)

Q1. How do I open a PPF account for my child?

A parent or legal guardian can open a minor’s PPF account by submitting the required KYC documents (proof of identity, address, and the child’s birth certificate) at any participating post office or authorized bank branch.

Q2. What options are available when the account matures after 15 years?

Upon maturity, you have three choices: withdraw the full amount, extend the account for another 5 years with continued deposits, or extend the account without making further contributions (in which case, the balance will continue to earn interest).

Q3. What happens if I miss depositing in a year?

The account will become inactive if the minimum annual deposit of ₹500 is not made. It can be reactivated by paying a penalty of ₹50 for each year of default, along with the minimum deposit for each inactive year.

Q4. How is the PPF interest rate determined?

The interest rate is announced by the Government of India’s Ministry of Finance every quarter. It is influenced by broader economic factors and government bond yields.

Q5. Can Non-Resident Indians (NRIs) open a PPF account?

NRIs are not eligible to open new PPF accounts. However, accounts opened while they were residents can be maintained until maturity but cannot be extended beyond the 15-year term.

Q6. Can I have multiple PPF accounts?

An individual is allowed to have only one PPF account in their own name. However, this limit does not apply to accounts opened on behalf of minor children, which a parent can manage separately.

Final Reflections

Choosing the Post Office PPF Scheme is an act of love and foresight. It represents a commitment to harnessing time, discipline, and security to build a bridge to your child’s dreams. By starting this journey early, you ensure that when the time comes for them to take pivotal steps in life, their path is supported by a foundation of financial stability, allowing them to focus fully on learning, growing, and achieving their full potential.